The Best Loan Options for Salaried vs. Self-Employed Individuals

Introduction

Choosing the right loan depends on multiple factors, including employment type. Salaried and self-employed individuals have different financial profiles, income stability, and documentation requirements, which affect their loan eligibility, interest rates, and repayment options. This guide breaks down the best loan options for each category and how to maximize your approval chances.

Key Differences Between Salaried and Self-Employed Borrowers

| Criteria | Salaried Individuals | Self-Employed Individuals |

|---|---|---|

| Income Stability | Fixed monthly salary | Variable income |

| Loan Approval | Easier due to stable income | Requires more financial proof |

| Interest Rates | Lower due to low-risk profile | Slightly higher due to income fluctuations |

| Documentation | Salary slips, bank statements, ITR | Business proof, ITR, profit & loss statements |

| Best Loan Options | Personal Loan, Home Loan, Car Loan | Business Loan, Loan Against Property, Working Capital Loan |

Best Loan Options for Salaried Individuals

1. Personal Loan

- No collateral required

- Quick approval and disbursement

- Fixed EMIs for easy repayment

2. Home Loan

- Long tenure with low interest rates

- Tax benefits available

- Higher loan amounts approved based on salary

3. Car Loan

- Fixed EMIs for vehicle purchase

- Lower interest rates for salaried individuals

- Easy processing with minimum documentation

4. Credit Card Loan

- Instant access to funds without additional paperwork

- Higher credit limits for salaried professionals

Best Loan Options for Self-Employed Individuals

1. Business Loan

- Ideal for expansion, working capital, and investment

- Higher loan amounts based on business turnover

- Flexible repayment options

2. Loan Against Property (LAP)

- Lower interest rate compared to personal loans

- High loan amounts based on property value

- Long repayment tenure

3. Working Capital Loan

- Helps manage daily operational expenses

- Short-term funding solution

- Flexible withdrawal and repayment options

4. Gold Loan

- Instant loan against gold assets

- Minimal documentation required

- Ideal for quick short-term funding

How Fair Finance Can Help You

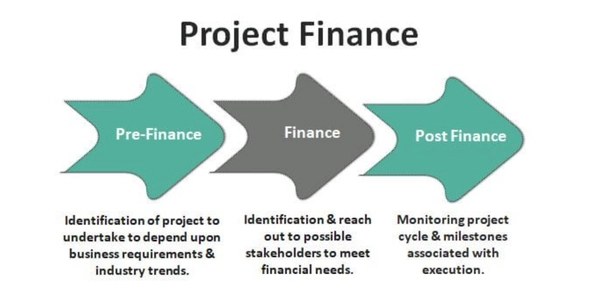

At Fair Finance, we understand the distinct challenges faced by both salaried and self-employed individuals when securing a loan. Our advanced AI-driven loan advisory platform helps you:

- Compare the best loan offers across banks and NBFCs based on your financial profile.

- Fast-track your application with same-day approval and response within 60 minutes.

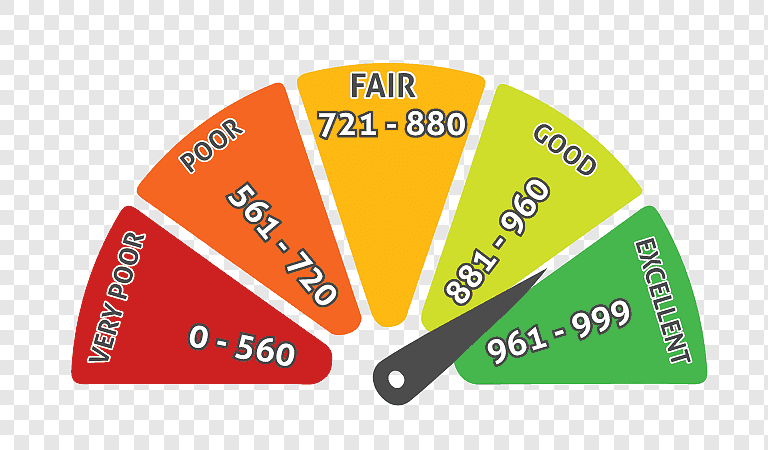

- Secure loans even with low credit scores by negotiating with lenders on your behalf.

- Provide customized loan solutions, ensuring you get the best terms and interest rates.

- Assist with document verification and eligibility compliance, making the process hassle-free.

Conclusion

Whether you are a salaried professional looking for a home or personal loan, or a self-employed entrepreneur seeking business funding, Fair Finance ensures you get the best possible loan options tailored to your needs. Get expert assistance, compare loan offers, and secure the best financial solutions with Fair Finance today!

Need a Loan? Contact Fair Finance for a free consultation and personalized loan options.

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198