Loans & Credits

MONEY MATTERS !

- So take your decision wisely!

Most frequent questions and answers

Before you apply for any kind of loan kindly do read out the following questions and answers to better understand your financial scenario and apply with the correct way.

WHAT IS A LOAN ?

Fair Finance : I must Admit it that it is a silly question to answer but you must go through it to understand the procedure.

A loan is a thing or agreement done between two parties specially against money to be borrowed in expectation to be paid back with Interest and principle.

HOW TO GET A LOAN ?

The answer is very Simple, If you have proper & authentic documentations as per required you are eligible to get a loan from most of the financial Institutions but as per terms and conditions.

HOW CAN I GET THE DOCUMENTS ?

This question comes almost more than two times everyday to us but again it must need to be reminded that any financial institution will give you any kind of loan but yes based on your income. Yes your running one not any kind of projected one for sure and yes even if you make the documents that does not confirm your eligibility as institutions must at least check and verify a quite longer period of time to make any decision on your running income and outcome from your earning flow.

WHAT IS THE BEST LOAN IN MARKET ?

Obviously we recommend to go for secured loan every time as it gives you half interest rates in compare to unsecured one. to better understand loan categories kindly look at next question and answer.

HOW MANY KIND OF LOANS ARE THERE?

There are a plenty of kind to select, it differs from loan category to institutions to your earning models. Most of they have a pattern but might be in different names although there are the most common matter and that way we can divide it in three categories.

A. Secured

B. Unsecured

C. Semi Secured

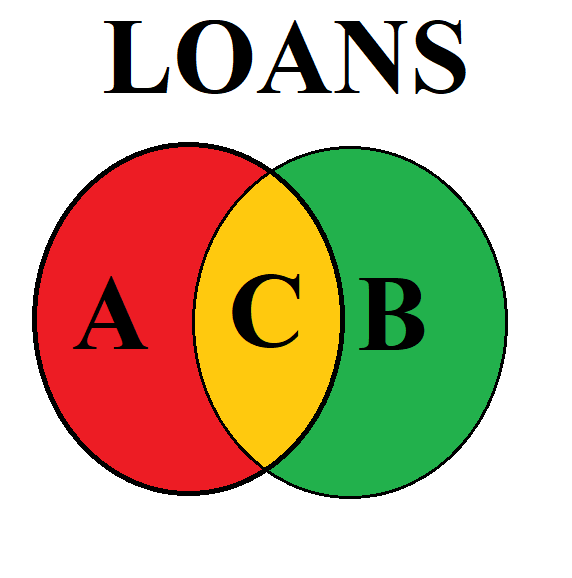

Now from this Image if we consider these two circles are as all kind of loans then

A. red-colored place is an Unsecured loan(Means the whole amount whatever has been disbursed to you has been given on goodwill and based on your running income proof not on projected one) i.e:- Personal loan, Business Loan, or Credit Card

B. green-colored place is secured loan(means whatever secured property has been taken as collateral, a certain part of the market value has been disbursed to you) i.e.:- home loan, mortgage loan term loan, etc.

C. yellow colored place is semi secured loan (means part or the disbursement amount is given against any kind of security) i.e.:- Mudra loan, CC or OD, etc.

HOW MANY KIND OF LOANS ARE THERE ?

There are a lot of kind of Loans and Loan categories are there, although here I have attached a few of the Hot products listed below. Kindly click on the images to know more about it.

UNSECURED : INSTANT LOANS

Click here to avail an unsecured loan in 15 minutes.

UNSECURED : MUDRA LOAN (PMMY)

Click here to avail an unsecured loan in 15 minutes.

UNSECURED: BUSINESS LOAN & PERSONAL LOAN (BL & PL)

Click here to avail an unsecured loan in 15 minutes.

UNSECURED : PROFESSIONAL LOANS

Click here to avail an unsecured loan in 15 minutes.

UNSECURED : PENSIONER LOAN

Click here to avail an unsecured loan in 15 minutes.

CREDIT CARD

Click here to avail an unsecured loan in 15 minutes.

HOME LOAN

Click here to avail an unsecured loan in 15 minutes.

BAD CIBIL LOANS

Click here to avail an unsecured loan in 15 minutes.

CASH CREDIT / OVER DRAFT (CC/OD)

Click here to avail an unsecured loan in 15 minutes.

MORTGAGE/ SECURED/TERM LOANS

Click here to avail an unsecured loan in 15 minutes.

BALANCE TRANSFER & TOP UP

Click here to avail an unsecured loan in 15 minutes.

STARTUP BUSINESS FUNDING

Click here to avail an unsecured loan in 15 minutes.

BANK GUARANTEE

Click here to avail an unsecured loan in 15 minutes.

LETTER OF CREDIT

Click here to avail an unsecured loan in 15 minutes.