How to Decide If You Are Eligible for a Loan Before Applying

Introduction

Applying for a loan without knowing your eligibility can lead to rejection, which may negatively impact your credit score. Understanding the key factors that determine loan eligibility helps you make informed decisions, increasing your chances of approval. This guide breaks down the essential criteria lenders consider and how you can assess your eligibility before submitting an application.

Key Factors That Determine Loan Eligibility

1. Credit Score and Credit History

Your credit score is a crucial factor in loan approvals. Lenders use it to evaluate your repayment history and financial discipline.

- A credit score above 750 improves approval chances.

- A low score (below 650) can result in higher interest rates or rejection.

- Regular repayment of existing loans and credit card bills helps maintain a good credit score.

2. Income and Employment Stability

Your monthly income and employment type determine the amount and type of loan you qualify for.

- Salaried Employees: Stable income with at least 6 months in the current job.

- Self-Employed Individuals: Steady business revenue with financial records of at least 2 years.

- Higher income levels can result in better loan terms and higher loan amounts.

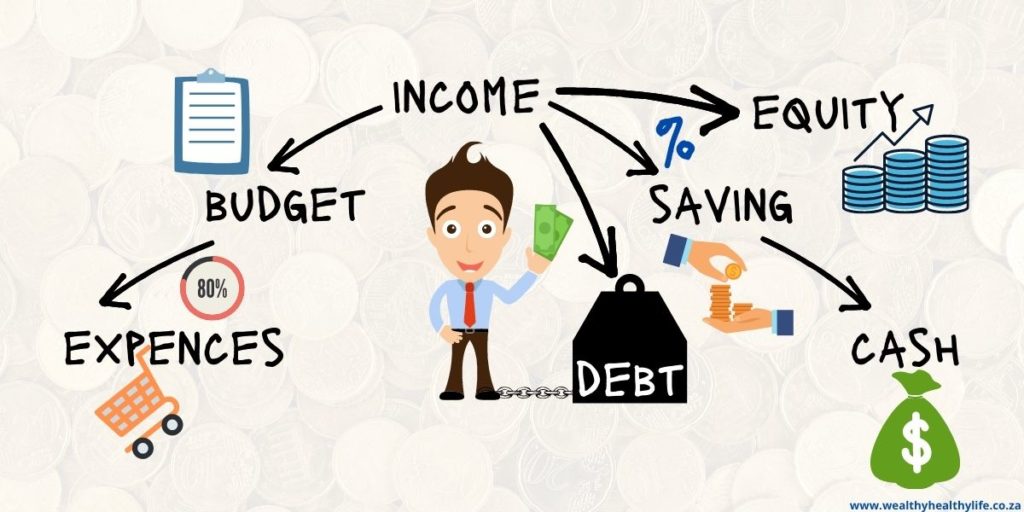

3. Debt-to-Income Ratio (DTI)

DTI compares your total monthly debt obligations to your income.

- Ideally, your DTI should be below 40% to be considered financially stable.

- A lower DTI increases approval chances and helps negotiate better interest rates.

4. Age and Loan Tenure

Lenders prefer applicants who have sufficient working years left to repay the loan comfortably.

- Most loans require applicants to be between 21-60 years old.

- Shorter loan tenure requires higher EMIs but lowers the total interest paid.

- Longer tenure reduces EMI burden but increases total interest cost.

5. Type of Loan and Collateral

Different loans have different eligibility criteria.

- Secured Loans (Home Loan, Loan Against Property, Gold Loan) require collateral, making them easier to obtain even with lower credit scores.

- Unsecured Loans (Personal Loan, Business Loan) depend heavily on income, credit score, and financial stability.

How to Check Your Loan Eligibility

- Use Online Loan Eligibility Calculators – Many financial institutions provide tools that help estimate your eligibility based on income, credit score, and DTI.

- Request a Credit Report – Check your credit score through CIBIL or other credit bureaus to understand your standing.

- Assess Your Existing Debts – Ensure your DTI is within a manageable limit before applying.

- Pre-Approval from Lenders – Some lenders offer pre-approved loans based on your profile and creditworthiness.

How Fair Finance Can Help You Assess Loan Eligibility

At Fair Finance, we simplify the loan eligibility process with our AI-driven assessment system, ensuring:

- Instant credit score evaluation to determine your eligibility.

- Customized loan recommendations based on your income, DTI, and financial profile.

- Expert advisory support to guide you through eligibility improvement strategies.

- Pre-approved loan offers to increase approval chances.

- Assistance for low-credit applicants with alternative loan options and credit-building strategies.

Conclusion

Understanding loan eligibility before applying helps you avoid rejections and secure the best loan offers. Evaluating your credit score, income, DTI, and loan type is essential in making the right choice. With Fair Finance, you get expert-backed guidance, ensuring a smooth and hassle-free loan application process.

Ready to check your eligibility? Contact Fair Finance today and get the best loan options tailored for you!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198