How Online Loan Traps Work & Ways to Protect Yourself

The rise of digital lending has made it easier than ever to get quick loans online. However, with convenience comes risk. Many online lending platforms operate fraudulently, trapping unsuspecting borrowers into cycles of debt with hidden fees, high-interest rates, and unethical practices. Understanding how these online loan traps work and how to protect yourself is crucial for your financial well-being.

How Online Loan Traps Work

1. Instant Approval & Minimal Verification

Fraudulent online lenders often lure borrowers with promises of instant approval without any credit checks. While this seems attractive, it means they are not operating under any official regulatory framework.

2. Hidden Charges & High-Interest Rates

Many unauthorized lenders advertise low-interest rates but later impose hidden charges, processing fees, and late penalties, which are not disclosed upfront. These additional fees can skyrocket the repayment amount.

3. Auto-Debit & Unauthorized Withdrawals

Some fraudulent lending apps demand access to your bank account for “easy repayments.” They misuse this access to make unauthorized withdrawals, draining your funds without prior notice.

4. Harassment & Threats for Loan Recovery

Once a borrower fails to repay, these lenders resort to aggressive tactics, including threats, public shaming, and harassment through multiple calls, messages, and social media exposure.

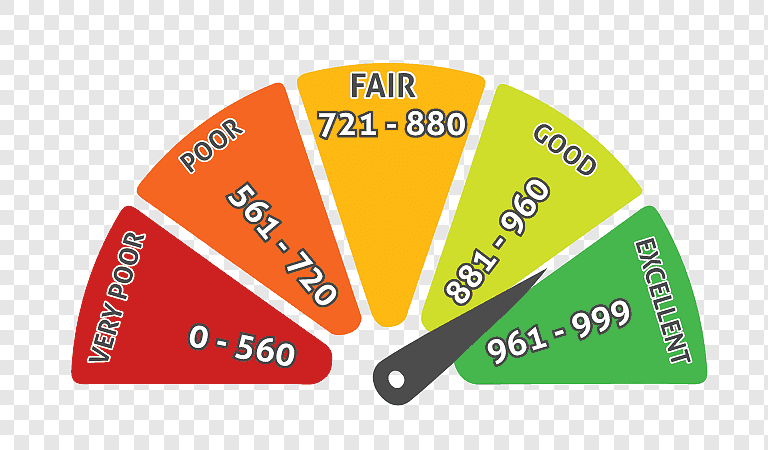

5. No NOC or Credit Score Benefits

Even after full repayment, many unauthorized lenders fail to remove the borrower’s details from their records. Since they do not report repayments to credit bureaus, borrowers do not improve their credit scores, preventing them from obtaining loans from legitimate institutions.

Ways to Protect Yourself from Online Loan Traps

1. Verify the Lender’s Legitimacy

Before applying, check if the lender is registered with financial regulators such as the Reserve Bank of India (RBI) or other national financial authorities.

2. Read the Terms & Conditions Carefully

Do not rush into signing agreements without reading the fine print. Pay close attention to interest rates, processing fees, and hidden charges.

3. Avoid Granting Unnecessary App Permissions

Many fraudulent lending apps ask for access to your contacts, messages, and photos. This personal data can be misused for harassment if you default on repayment.

4. Prefer Regulated Financial Institutions

Always choose banks, NBFCs, or reputed financial advisory platforms like Fair Finance, which offer transparent loan services with fair interest rates and legal protections.

5. Beware of Upfront Payment Scams

Legitimate lenders do not ask for upfront payments, security deposits, or processing fees before loan approval. Avoid lenders who demand money before processing your application.

6. Seek Financial Advice Before Borrowing

Consult financial experts or advisors like Fair Finance before taking any loan. We can help you assess your financial situation and find the best loan options with fair terms.

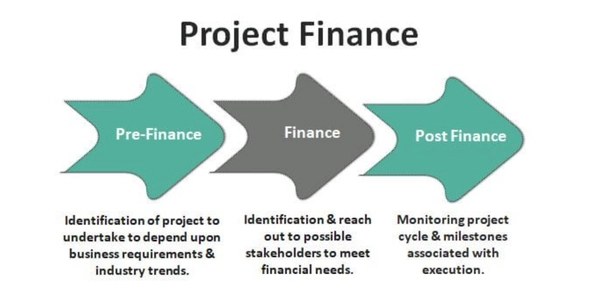

How Fair Finance Can Help You Avoid Online Loan Traps

At Fair Finance, we specialize in helping borrowers find legitimate loan options while avoiding scams and fraud. Our AI-driven platform ensures that you receive safe, regulated, and transparent loan offers tailored to your financial needs.

✔️ We compare all legitimate loan options for you

✔️ We ensure transparency with no hidden charges

✔️ We guide you on safe borrowing practices

✔️ We assist with credit score improvements and financial planning

⚡ Want a safe and secure loan? Contact Fair Finance today and get the best loan offers from trusted lenders!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198