Top 10 Mistakes People Make While Applying for a Loan & How to Avoid Them

Applying for a loan is a significant financial decision, but many borrowers make critical mistakes that lead to unnecessary rejections, higher interest rates, and long-term financial stress. To ensure you get the best loan deal, avoid these common pitfalls and follow expert strategies for a smooth borrowing experience.

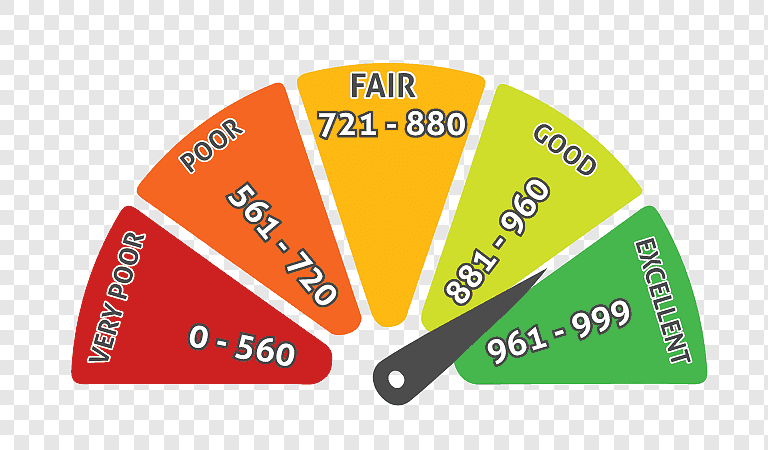

1. Not Checking Credit Score Before Applying

Mistake: Many borrowers apply for loans without reviewing their credit score, which plays a crucial role in loan approval and interest rates.

How to Avoid: Always check your CIBIL score before applying. If your score is low, work on improving it before submitting your application.

2. Applying for Multiple Loans Simultaneously

Mistake: Sending applications to multiple lenders at once results in multiple hard inquiries on your credit report, which negatively impacts your credit score.

How to Avoid: Compare loan offers online and apply for only one or two loans that best match your financial profile.

3. Ignoring Loan Eligibility Criteria

Mistake: Many applicants fail to check if they meet the lender’s eligibility requirements, leading to rejection.

How to Avoid: Always verify the minimum income, employment status, credit score, and loan tenure eligibility before applying.

4. Not Comparing Interest Rates & Loan Terms

Mistake: Some borrowers accept the first loan offer they receive without comparing different options.

How to Avoid: Use online loan comparison tools or consult with Fair Finance to get the best loan deal with lower interest rates and better terms.

5. Overlooking Hidden Charges & Fees

Mistake: Borrowers often focus only on interest rates and ignore processing fees, prepayment penalties, and foreclosure charges.

How to Avoid: Read the loan agreement carefully and ask for a breakdown of all charges before signing.

6. Choosing a Longer Loan Tenure Unnecessarily

Mistake: While longer tenure reduces EMI, it also increases the total interest payable.

How to Avoid: Choose an optimal tenure that balances affordable EMIs with the lowest overall interest cost.

7. Borrowing More Than You Can Repay

Mistake: Taking a loan amount higher than your repayment capacity leads to financial stress and possible default.

How to Avoid: Use a loan EMI calculator and ensure your total EMIs do not exceed 40% of your monthly income.

8. Providing Incorrect or Incomplete Documentation

Mistake: Submitting incorrect or missing documents leads to delays or rejection.

How to Avoid: Double-check KYC documents, income proofs, property papers (for secured loans), and employment details before applying.

9. Not Reading the Terms & Conditions Properly

Mistake: Many borrowers skip the fine print, leading to surprises later regarding penalties, auto-debit terms, or loan restructuring rules.

How to Avoid: Always read and understand the full loan agreement before signing.

10. Not Seeking Professional Advice

Mistake: Borrowers often rely on lender representatives who may push their own products instead of suggesting the best loan option.

How to Avoid: Consult a trusted loan advisory service like Fair Finance, which offers unbiased loan comparisons, guidance, and support throughout the loan process.

How Fair Finance Helps You Avoid These Mistakes

At Fair Finance, we ensure you make informed financial decisions by:

✅ Assessing your credit score & eligibility before you apply

✅ Comparing loan offers from multiple banks, NBFCs, and private lenders

✅ Identifying hidden charges & fees to help you save money

✅ Providing expert consultation to help you select the best loan option

✅ Ensuring smooth loan processing with minimal documentation

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198