How to Plan Your Finances Before Taking a Loan & Avoid Debt Traps

Taking a loan can be a smart financial decision when managed correctly, but poor planning can lead to serious financial distress. Whether it’s a personal loan, home loan, or business loan, understanding how to plan your finances before borrowing is crucial to avoid falling into a debt trap.

Here’s a step-by-step guide to help you make the right decisions and secure a loan without jeopardizing your financial health.

1. Assess Your Loan Requirement & Borrow Responsibly

Before applying for a loan, ask yourself:

✔ Do I really need this loan, or is it a luxury expense?

✔ How much do I actually need, and can I repay it comfortably?

✔ Are there any alternative ways to fund my needs without borrowing?

Tip: Borrow only what is necessary to avoid unnecessary financial burden.

2. Check Your Income & Repayment Capacity

Lenders assess your income stability to determine loan eligibility. Follow these steps:

✔ Calculate your monthly income after deducting all expenses.

✔ Keep your EMI below 40% of your monthly income for financial safety.

✔ Ensure you have a steady income flow to meet EMI obligations.

Example: If your monthly income is ₹50,000, your total loan EMI should not exceed ₹20,000 to maintain financial stability.

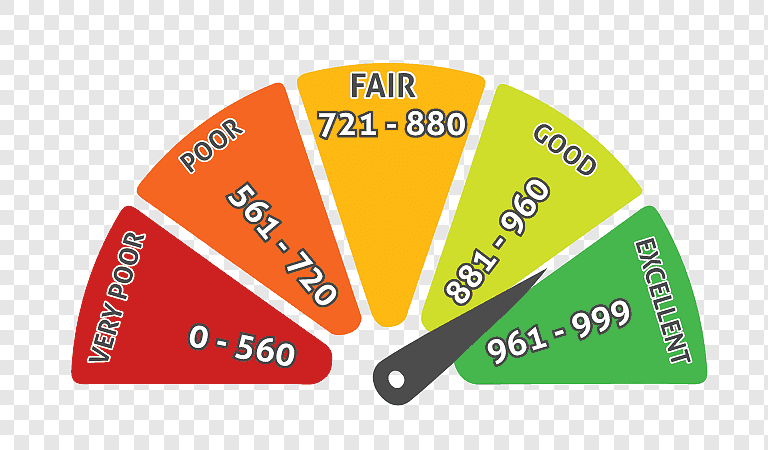

3. Know Your Credit Score & Improve If Necessary

A higher credit score (750+) increases loan approval chances and helps secure lower interest rates.

✔ Check your CIBIL or CRIF score before applying.

✔ Pay off outstanding dues & avoid multiple loans before applying for a new one.

✔ Ensure all past loans are closed properly with an NOC (No Objection Certificate).

Fair Finance can help you improve your credit score and fix credit history-related issues permanently.

📞 Need help improving your credit score? Apply for a paid consultation now.

4. Compare Loan Offers & Interest Rates

Every lender has different loan terms. Compare options to get the best deal:

✔ Look for competitive interest rates.

✔ Check processing fees, prepayment charges, and hidden costs.

✔ Understand the repayment tenure and EMI structure.

Tip: A slightly lower interest rate can save you lakhs over the loan tenure.

5. Choose the Right Loan Tenure

Selecting the right loan tenure helps in managing EMIs effectively.

| Loan Tenure | Pros | Cons |

|---|---|---|

| Short-Term (1-5 years) | Lower overall interest cost | Higher EMIs, more burden on income |

| Long-Term (10-30 years) | Lower monthly EMIs | Higher total interest paid |

Example: A ₹10 lakh loan at 10% interest for 5 years will have an EMI of ₹21,247, while a 10-year tenure will reduce EMI to ₹13,215 but increase total interest paid.

6. Plan for Emergency Situations

Unexpected financial setbacks (job loss, medical emergency) can impact loan repayment.

✔ Build an emergency fund covering 6-12 months’ expenses.

✔ Opt for loan protection insurance if required.

✔ Ensure you have multiple income sources for financial security.

Tip: Never exhaust your savings while repaying a loan—always have a backup fund.

7. Avoid Multiple Loans & Unnecessary Borrowing

Taking too many loans can create a financial burden and lower your credit score.

✔ Clear existing debts before taking a new loan.

✔ Avoid using credit cards for unnecessary expenses while repaying a loan.

✔ Focus on repaying high-interest loans first (credit card debts, payday loans, etc.).

Example: If you already have a home loan and a car loan, adding a personal loan may increase your EMI burden, making it difficult to manage finances.

8. Read Loan Terms & Conditions Carefully

Before signing a loan agreement:

✔ Check for hidden charges (processing fees, late payment fees, foreclosure charges).

✔ Understand prepayment options—some lenders charge penalties for early loan closure.

✔ Verify loan terms related to defaults, interest rate hikes, and tenure changes.

Tip: Never rush into signing loan documents. Clarify every term before proceeding.

How Fair Finance Can Help You Plan & Get the Best Loan

Fair Finance ensures that you:

✅ Choose the right loan option based on your income and financial stability.

✅ Get expert guidance on loan eligibility & credit score improvement.

✅ Compare multiple lenders to secure the lowest interest rates.

✅ Avoid loan traps and hidden charges with transparent financial planning.

📞 Want expert financial planning before taking a loan? Apply for a paid consultation now!

By planning wisely and making informed decisions, you can secure a loan without financial stress and avoid falling into a debt trap. Always borrow responsibly and ensure you can repay on time to maintain financial stability. 🚀

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198