How to Accurately Calculate Your EMI Before Applying for a Loan

Taking a loan is a major financial decision, and one of the most important aspects to consider before borrowing is the Equated Monthly Installment (EMI). Your EMI determines how much you’ll need to pay every month, impacting your budget and financial planning. Accurately calculating your EMI before applying for a loan helps you avoid financial strain and ensures a smooth repayment process.

In this guide, we will explain how to accurately calculate your EMI, understand the factors that affect it, and how you can plan your finances efficiently before taking a loan.

👉 Use our EMI calculator to calculate your EMI instantly!

1. What is an EMI & Why is it Important?

An Equated Monthly Installment (EMI) is the fixed amount you pay every month towards your loan repayment, consisting of:

✔ Principal Amount – The actual loan amount borrowed

✔ Interest Amount – The cost charged by the lender on the principal

✔ Loan Tenure – The repayment period chosen

Your EMI remains constant throughout the tenure for fixed-rate loans, while it may vary for floating-rate loans.

Why EMI Calculation is Important?

✅ Helps you determine whether the loan is affordable

✅ Prevents financial strain by ensuring EMI fits within your budget

✅ Allows you to choose the right tenure and interest rate

✅ Helps you compare multiple loan offers and get the best deal

👉 Use our EMI calculator to estimate your monthly payments!

2. Formula to Calculate EMI

EMI is calculated using the standard formula: EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1+r)^n}{(1+r)^n – 1}

Where:

🔹 P = Loan amount (Principal)

🔹 r = Monthly interest rate (Annual interest rate / 12 / 100)

🔹 n = Number of months (Loan tenure in years × 12)

Example Calculation:

Suppose you take a ₹10,00,000 loan at an interest rate of 10% per annum for 5 years (60 months).

🔹 P = ₹10,00,000

🔹 r = 10% ÷ 12 ÷ 100 = 0.00833

🔹 n = 5 × 12 = 60

Now, applying the formula: EMI=10,00,000×0.00833×(1+0.00833)60(1+0.00833)60−1EMI = \frac{10,00,000 \times 0.00833 \times (1+0.00833)^{60}}{(1+0.00833)^{60} – 1} EMI=₹21,247EMI = ₹21,247

So, your monthly EMI for a ₹10 lakh loan at 10% interest for 5 years will be ₹21,247.

Tip: Instead of manual calculations, you can use an online EMI calculator for quick results.

👉 Use our EMI calculator to simplify your calculations!

3. Factors That Affect Your EMI Amount

Understanding these factors helps in planning your loan efficiently:

✅ Loan Amount (Principal)

🔹 Higher loan amount = Higher EMI

🔹 Borrow only what is necessary to avoid financial burden

✅ Interest Rate

🔹 Higher interest rates increase your EMI amount

🔹 Compare multiple lenders to find the lowest rate

✅ Loan Tenure

🔹 Shorter tenure = Higher EMI but lower total interest

🔹 Longer tenure = Lower EMI but higher total interest paid

| Loan Tenure | EMI (₹10 lakh @10%) | Total Interest Paid |

|---|---|---|

| 5 Years | ₹21,247 | ₹2,74,820 |

| 10 Years | ₹13,215 | ₹5,85,800 |

| 15 Years | ₹10,746 | ₹9,34,325 |

🔹 Choose a balance between affordable EMI and low total interest payout.

👉 Use our EMI calculator to explore different loan tenures!

4. How to Choose the Right EMI for You

🔹 Step 1: Check Your Monthly Income & Expenses

✔ Ensure EMI is below 40% of your monthly income

✔ Keep a buffer for emergency expenses

Example: If your monthly income is ₹50,000, keep your EMI below ₹20,000 for financial safety.

🔹 Step 2: Compare Different Loan Options

✔ Use an EMI calculator to check EMI for different loan tenures

✔ Opt for a tenure that gives a comfortable EMI without excess interest

🔹 Step 3: Consider Prepayment & Part-Payment Options

✔ Choose a loan that allows prepayment without high penalties

✔ Making lump sum payments reduces interest burden

Tip: If you expect salary hikes or bonuses, opt for loans that allow flexible prepayments.

5. Avoid These Common Mistakes While Calculating EMI

🔻 Not considering additional charges (processing fees, penalties, etc.)

🔻 Overestimating repayment capacity and choosing high EMIs

🔻 Ignoring interest rate fluctuations in case of floating-rate loans

🔻 Not comparing multiple lenders before finalizing a loan

Solution: Always consult a financial expert before choosing a loan to avoid costly mistakes.

👉 Use our EMI calculator before making your final decision!

6. How Fair Finance Helps You Choose the Best Loan & EMI Plan

At Fair Finance, we ensure that you:

✅ Choose the right EMI plan based on your income and financial goals

✅ Compare multiple lenders to get the lowest interest rates

✅ Avoid loan traps & hidden charges with expert financial planning

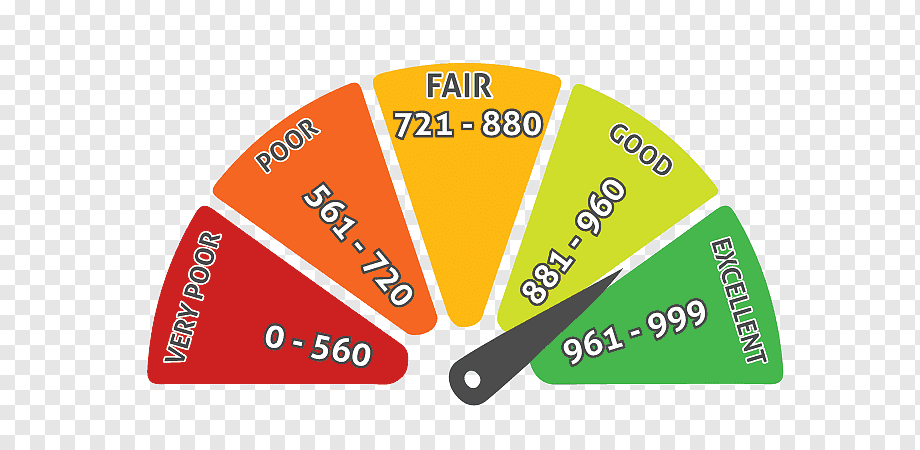

✅ Get assistance in improving your credit score for better loan approval

📞 Need help calculating the perfect EMI for your loan? Apply for a paid consultation now!

Final Thoughts:

Calculating your EMI accurately before applying for a loan prevents financial stress and ensures smooth repayment. Always compare different loan options, consider your income stability, and choose a balanced tenure that fits your budget.

👉 Use our EMI calculator to make informed financial decisions!

Borrow smartly, plan wisely, and secure your financial future with Fair Finance! 🚀

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198