What is a Debt Trap? How to Avoid It?

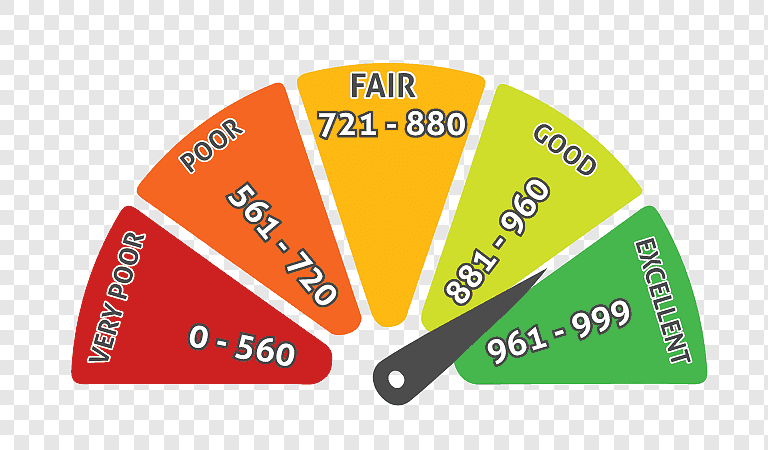

Debt can be a useful financial tool when managed wisely, but it can quickly spiral out of control if not handled properly. Many individuals fall into a debt trap, struggling to make repayments while accumulating more debt. This situation can lead to financial stress, poor credit scores, and even bankruptcy.

In this guide, we will explain:

✔ What a debt trap is

✔ How people fall into it

✔ Signs that you are in a debt trap

✔ Proven strategies to avoid and escape it

1. What is a Debt Trap?

A debt trap occurs when a person takes on more debt than they can repay, leading to a cycle where they borrow new loans to pay off existing debts. Over time, interest accumulates, making it harder to break free from financial obligations.

🔹 Example of a Debt Trap

👉 You take a ₹50,000 personal loan but struggle to pay the EMI.

👉 To cover the EMI, you take another loan of ₹30,000.

👉 Now, you have two loans and double the EMIs to pay.

👉 As debt piles up, you borrow even more, leading to a vicious cycle of borrowing and repayment.

🚨 Result? You end up paying high interest while your financial situation worsens.

2. Common Reasons Why People Fall Into a Debt Trap

🔴 1. High-Interest Loans & Credit Card Debt

✔ Credit cards and payday loans charge 24%-60% annual interest.

✔ If you don’t clear the full balance, interest keeps compounding.

🔴 2. Relying on Borrowing for Everyday Expenses

✔ If you use credit cards or loans for daily expenses, you are overspending.

✔ Living beyond your means eventually leads to a debt trap.

🔴 3. Taking Multiple Loans Simultaneously

✔ Many people take personal loans, car loans, home loans, and credit card debt at the same time.

✔ Too many EMIs lead to cash flow problems, making repayment difficult.

🔴 4. Only Paying the Minimum Due on Credit Cards

✔ If you pay only the minimum due, the remaining balance accumulates high interest.

✔ This increases your overall debt burden.

🔴 5. Unforeseen Financial Emergencies

✔ Medical emergencies, job loss, or unexpected expenses force people to borrow money without a repayment plan.

✔ Without a financial backup, they depend on loans and credit cards, worsening the situation.

🔴 6. Poor Financial Planning

✔ Not tracking expenses, overspending, and ignoring savings can lead to a debt trap.

✔ Many people take loans without checking affordability.

3. Warning Signs That You Are in a Debt Trap

🚨 If you notice these red flags, you may be heading toward a debt trap:

🔹 Struggling to pay EMIs on time

🔹 Taking new loans to repay old ones

🔹 Paying only the minimum due on credit cards

🔹 Credit card balance increasing every month

🔹 High debt-to-income ratio (DTI) over 40%

🔹 No savings left after paying EMIs

🔹 Receiving frequent calls from lenders for overdue payments

If any of these apply to you, it’s time to take action before your debt worsens.

4. How to Avoid Falling Into a Debt Trap

✅ 1. Borrow Only What You Can Afford to Repay

✔ Follow the 50-30-20 Rule:

- 50% of income for necessities

- 30% for lifestyle

- 20% for savings & debt repayment

✔ Ensure your total EMIs do not exceed 30-40% of your income.

✅ 2. Pay More Than the Minimum on Credit Cards

✔ Always clear the full outstanding balance to avoid high interest.

✔ If unable to pay in full, pay more than the minimum amount to reduce interest burden.

✅ 3. Consolidate & Refinance High-Interest Debt

✔ If you have multiple loans, consider debt consolidation to merge them into a single lower-interest loan.

✔ Refinancing can reduce EMIs and extend repayment periods, making debt manageable.

✅ 4. Create an Emergency Fund

✔ Save at least 3-6 months’ worth of expenses in a liquid fund.

✔ This prevents you from borrowing in case of unexpected financial needs.

✅ 5. Avoid Unnecessary Loans & EMIs

✔ Don’t take loans for luxuries like vacations, gadgets, or high-end cars if you can’t afford them.

✔ Stick to planned purchases that fit within your budget.

✅ 6. Increase Your Income & Reduce Expenses

✔ Consider side income sources like freelancing, part-time jobs, or investments.

✔ Cut down on non-essential expenses like subscriptions, dining out, or luxury purchases.

✅ 7. Seek Professional Help If Needed

✔ If you’re struggling, consult a financial advisor or debt management expert.

✔ A professional can negotiate with lenders and help you plan a structured debt repayment strategy.

5. How to Get Out of a Debt Trap?

If you are already in a debt trap, here’s how to escape:

🔹 Step 1: List All Your Debts & Prioritize

✔ Rank debts based on interest rates and urgency.

✔ Pay off high-interest loans first (credit cards, payday loans, personal loans).

🔹 Step 2: Follow the Snowball or Avalanche Method

✔ Debt Snowball: Pay smallest loans first to build momentum.

✔ Debt Avalanche: Pay highest-interest loans first to save money.

🔹 Step 3: Negotiate with Lenders for Better Terms

✔ Request lower interest rates, longer tenure, or settlement options.

✔ Some banks offer loan restructuring for struggling borrowers.

🔹 Step 4: Avoid Taking More Loans

✔ Stop using credit cards until you clear existing debt.

✔ Avoid payday loans, as they worsen the situation.

🔹 Step 5: Increase Income & Cut Unnecessary Expenses

✔ Pick up freelancing, part-time jobs, or investments to increase earnings.

✔ Reduce spending on entertainment, luxury, and non-essentials.

🔹 Step 6: Use Lump Sum Money to Pay Off Debt

✔ If you get a bonus, tax refund, or inheritance, use it to clear high-interest loans.

✔ Avoid spending lump sums on luxuries.

6. Final Thoughts: Smart Borrowing Leads to Financial Freedom

💡 A debt trap is easy to fall into but difficult to escape. However, with proper financial planning, discipline, and smart borrowing, you can avoid it and achieve financial freedom.

✅ Golden Rule:

👉 Borrow only when necessary, ensure timely repayment, and maintain a strong savings plan.

📞 Need expert financial guidance? Contact Fair Finance for debt management strategies and customized loan solutions.

🚀 Stay debt-free & financially strong!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198