Can You Prepay Your Loan? Pros & Cons of Early Loan Repayment

Paying off a loan before its scheduled tenure—also known as loan prepayment—can be a great financial decision in some cases, but it also comes with potential downsides. Before making a lump sum payment towards your loan, it is essential to understand the benefits, drawbacks, and best strategies for early repayment.

In this guide, we will explore:

✔ What loan prepayment is and how it works

✔ The advantages and disadvantages of early loan repayment

✔ Factors to consider before making a prepayment decision

1. What is Loan Prepayment?

Loan prepayment refers to partially or fully paying off your loan before the scheduled end of its tenure. There are two types of prepayment:

🔹 Partial Prepayment – Paying a lump sum amount to reduce the loan principal while continuing EMI payments.

🔹 Full Prepayment (Foreclosure) – Paying off the entire outstanding loan balance before the end of the tenure.

Example: If you took a ₹10 lakh loan for 10 years and after 5 years you receive a bonus or inheritance, you may choose to prepay ₹2 lakh as a lump sum, reducing your future EMIs or tenure.

2. Pros of Prepaying Your Loan

✅ 1. Saves Interest Costs

✔ The sooner you repay your loan, the less interest you pay overall.

✔ If prepayment is done in the early years, you save a significant amount as most interest is charged in the initial phase.

Example:

If you have a ₹10 lakh home loan at 8% for 20 years, your total interest payable is ₹9.95 lakh.

🔹 If you prepay ₹2 lakh in the 5th year, you can save around ₹3-4 lakh in interest costs!

✅ 2. Reduces EMI or Loan Tenure

✔ A lump sum prepayment can either:

- Lower your EMI, making monthly payments more manageable.

- Shorten your loan tenure, helping you become debt-free sooner.

Tip: If you can afford your current EMI, opt for a shorter tenure to maximize savings.

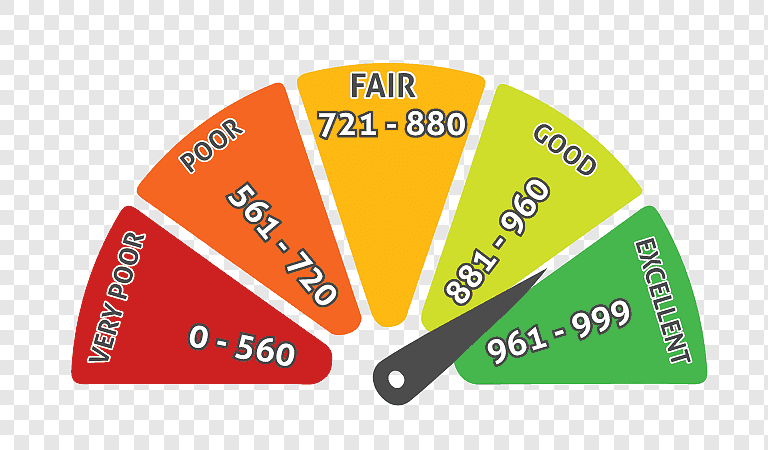

✅ 3. Improves Financial Security

✔ Prepaying a loan reduces your overall debt burden.

✔ Lower liabilities mean better creditworthiness and financial peace of mind.

✅ 4. Frees Up Monthly Income for Other Investments

✔ Reducing EMI payments allows you to allocate more funds toward higher-return investments, retirement savings, or business expansion.

✔ Instead of paying long-term loan interest, you can invest in stocks, mutual funds, or real estate for better returns.

3. Cons of Prepaying Your Loan

❌ 1. Prepayment Penalty Charges

🔹 Many banks and NBFCs charge a prepayment penalty (usually 2-5%) on the amount repaid, especially for fixed-rate loans.

🔹 Home loans with floating interest rates are exempt from prepayment charges, as per RBI guidelines.

Example:

If you repay ₹5 lakh early on a loan with a 3% prepayment charge, you’ll have to pay an extra ₹15,000 as a penalty.

❌ 2. Loss of Tax Benefits (For Home & Education Loans)

🔹 Home loans offer tax deductions on principal (Section 80C) and interest (Section 24B) payments.

🔹 If you prepay the loan early, you lose out on tax-saving benefits.

Example:

A ₹20 lakh home loan at 8% interest gives a tax benefit of up to ₹2 lakh per year on interest payments under Section 24B. If you prepay the loan, you miss out on this deduction.

❌ 3. Lower Liquidity & Emergency Fund Risks

🔹 Using all your savings for prepayment can leave you cash-strapped during emergencies.

🔹 It’s essential to maintain an emergency fund of at least 6-12 months of expenses before considering prepayment.

Tip: Instead of using all your savings, make partial prepayments while keeping an emergency reserve.

❌ 4. Opportunity Cost – Could You Invest for Higher Returns?

🔹 If your loan interest rate is low (6-8%), but you can invest in assets that generate higher returns (12-15%), prepayment might not be the best option.

🔹 Consider whether investing in mutual funds, stocks, or business opportunities would yield better financial growth than prepaying your loan.

Example: If your home loan interest rate is 7%, but your investments can generate 12% returns, it’s better to invest rather than prepay.

4. When Should You Prepay Your Loan?

✔ If you have surplus funds that won’t affect emergency savings.

✔ If your loan interest rate is higher than potential investment returns.

✔ If your prepayment penalty is low or zero.

✔ If your loan tenure is long, and you can save significant interest costs.

5. When Should You Avoid Prepaying Your Loan?

❌ If you need liquidity for emergencies or future investments.

❌ If the prepayment penalty is too high.

❌ If you are getting good tax benefits on home or education loans.

❌ If your loan interest rate is lower than the returns on alternative investments.

6. Smart Strategies for Loan Prepayment

🔹 Use bonuses, tax refunds, or windfall gains for prepayment instead of regular savings.

🔹 Make small, regular prepayments instead of one large payment to reduce loan tenure gradually.

🔹 Negotiate with your lender to reduce or waive prepayment charges.

🔹 Check loan terms before borrowing—opt for loans with flexible prepayment options.

Final Thoughts

Loan prepayment is a powerful financial tool, but it must be done strategically. It can save you lakhs in interest, but it may also come with penalties or tax implications. Before making a decision, analyze your financial situation, interest rates, tax benefits, and investment opportunities.

📞 Need expert advice on loan prepayment? Contact Fair Finance today!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198