The Complete Guide to Closing a Loan Without Hurting Your Credit Score

Closing a loan properly is just as important as repaying it on time. If done incorrectly, it can negatively impact your credit score, making it difficult to secure loans in the future.

In this guide, we’ll cover:

✅ Steps to close a loan properly

✅ Common mistakes to avoid

✅ How loan closure affects your credit score

✅ How to ensure the closure is updated in your credit report

Let’s dive in! 🚀

1. Types of Loan Closures

There are three ways a loan can be closed:

✅ Regular Loan Closure (Best Option)

🔹 The borrower pays all EMIs as per schedule until the loan is completely repaid.

🔹 The lender marks the loan as “Closed” in credit bureau records.

✅ Impact on Credit Score: Positive or neutral impact, as it shows responsible repayment behavior.

✅ Prepayment or Foreclosure (Early Closure)

🔹 The borrower repays the full outstanding loan amount before the tenure ends.

🔹 The lender closes the loan and issues a No Objection Certificate (NOC).

✅ Impact on Credit Score: Slightly negative in some cases because lenders prefer loans to run for the full term (as they earn interest). However, if done occasionally, it does not cause major harm.

❌ Loan Settlement (Avoid This)

🔹 The borrower fails to repay the full amount, and the lender accepts a lower lump sum as “settlement.”

🔹 The loan is marked as “Settled” instead of “Closed” in credit reports.

🚨 Impact on Credit Score: Highly negative (reduces score by 50-100 points) and remains in records for up to 7 years.

🔴 Best Practice: Always aim for a Regular Closure or Prepayment, never Settlement.

2. Step-by-Step Guide to Closing a Loan Properly

🔹 Step 1: Pay the Final EMI and Verify Loan Balance

- Ensure all EMIs are paid and there are no outstanding dues.

- Contact the lender to get a final statement confirming the total due amount.

🔹 Step 2: Request a No Objection Certificate (NOC)

- Once the final payment is made, request an NOC from the lender.

- This document is proof that the loan is fully repaid, and the lender has no further claims.

🔹 Step 3: Collect Loan Closure Documents

After clearing your loan, ensure you receive:

✅ No Objection Certificate (NOC)

✅ Loan closure letter from the lender

✅ Original documents (for secured loans like home/mortgage loans)

🔹 Step 4: Check Credit Report for Loan Closure Update

- After 30-45 days, check your CIBIL report to confirm that the loan is marked as “Closed” instead of “Active” or “Settled.”

- If not updated, contact both:

- The lender’s Nodal & Principal Nodal Officer

- The credit bureau (CIBIL, Experian, Equifax, CRIF High Mark)

- If no action is taken, raise a complaint with RBI’s grievance cell.

🔹 Step 5: Maintain a Low Credit Utilization After Closure

- Avoid taking multiple new loans immediately after closure.

- Keep your credit utilization ratio below 30% to maintain a strong score.

3. Common Mistakes to Avoid When Closing a Loan

🚫 Not Collecting the NOC: Always get a written NOC from the lender.

🚫 Ignoring Credit Report Updates: Ensure the closure is correctly reflected in your CIBIL report.

🚫 Closing Credit Cards Abruptly: If closing a loan-based credit line (like a credit card), keep some activity to maintain credit history.

🚫 Settling Instead of Closing: Avoid settlement at all costs—it damages your credit score.

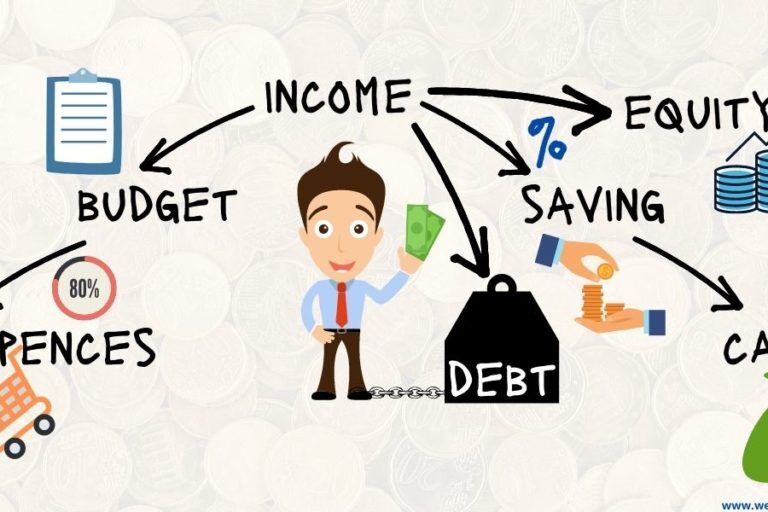

4. Final Thoughts: How Loan Closure Affects Your Credit Score

✅ Positive Effects of Loan Closure:

✔ Improves creditworthiness by proving responsible borrowing.

✔ Increases eligibility for future loans at better interest rates.

⚠ Situations Where Loan Closure Can Lower Your Score:

🔸 Closing a long-term loan too soon (e.g., early home loan closure) may cause a slight dip.

🔸 If you don’t have other active credit accounts, closing a loan can reduce your credit mix.

💡 Best Practice: Always maintain a healthy mix of credit types (loans + credit cards) to ensure a stable CIBIL score.

Conclusion: Close Your Loan the Right Way & Protect Your Credit Score!

✅ Always opt for full repayment or prepayment, not settlement.

✅ Ensure the lender updates your credit report to reflect “Closed” status.

✅ Maintain financial discipline even after loan closure.

Closing a loan should help, not hurt, your financial future. Follow these steps, and you’ll be on the right track! 🚀

🔹 Need help managing your loans or improving your credit score?

📞 Get expert consultation from Fair Finance today!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198