When Should You Take Loans? Advantages, Disadvantages, and Rational Considerations

Introduction

Loans can be powerful financial tools when used wisely. They provide access to funds for investments, emergencies, and asset acquisition. However, loans should not be taken on a whim—they must be preplanned, strategic, and aligned with your financial goals. In this guide, we discuss when you should take a loan, the advantages and disadvantages, and the rational considerations you must make before borrowing.

When Should You Take a Loan?

Taking a loan should be a calculated financial decision rather than a mere wish or impulse. Below are situations where taking a loan is a rational and beneficial move:

- For Asset Building – Loans for homes, businesses, or education create long-term value and wealth accumulation.

- For Business Growth – Entrepreneurs leverage business loans to scale operations, increase revenue, and improve cash flow.

- For Emergency Situations – Medical emergencies, urgent home repairs, or unforeseen expenses may justify a loan.

- For Investment Opportunities – If a high-return investment exceeds loan interest costs, borrowing can be a strategic move.

- For Debt Consolidation – A single, lower-interest loan can simplify debt repayment and reduce financial burden.

Advantages of Taking a Loan

Taking a loan can offer multiple benefits when managed properly:

- Helps in Building Credit Score – Timely repayment of loans improves creditworthiness.

- Facilitates Large Purchases – Loans enable asset acquisition, such as homes and vehicles, without upfront payments.

- Boosts Business Growth – Business loans help in expanding operations, increasing inventory, and hiring talent.

- Provides Financial Flexibility – Loans allow liquidity without depleting personal savings.

- Tax Benefits – Some loans, like home and education loans, offer tax deductions.

Disadvantages of Taking a Loan

While loans have their advantages, they come with risks:

- Interest Costs – Borrowing always involves interest, increasing the cost of repayment.

- Debt Burden – Poorly managed loans can lead to financial stress and long-term liabilities.

- Risk of Collateral Loss – Secured loans require assets as security, which may be lost in case of non-repayment.

- Impact on Credit Score – Missed payments negatively affect your credit profile, limiting future borrowing options.

The Rationality Behind Taking a Loan

A Loan is Not a Trap—It’s a Financial Weapon

Many people perceive loans as financial obligations or burdens, but in reality, loans can be powerful financial weapons when used strategically. If you master the art of leveraging debt, you can use it to accelerate your financial growth. For instance:

- A business loan can help expand operations and increase revenue beyond the loan amount.

- A home loan lets you own property while benefiting from appreciation and tax deductions.

- A personal loan for skill development can enhance career prospects and income potential.

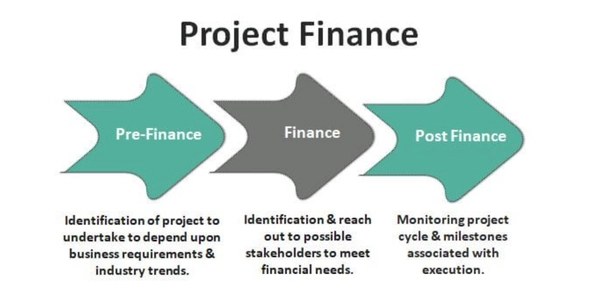

Loans Should Be a Preplanned Step, Not a Wish

Taking a loan should not be based on personal desires but rather as a step toward financial success. Strategic borrowing ensures that loans align with your income, repayment capability, and wealth-building plans. Key considerations before taking a loan include:

- Clear Purpose – Define why you need the loan and how it will help you financially.

- Repayment Capacity – Ensure that loan EMIs fit within your monthly budget.

- Comparing Loan Offers – Evaluate multiple lenders to get the best terms and conditions.

- Reading the Fine Print – Always understand hidden fees, interest rates, and foreclosure policies.

Conclusion

Loans are not just liabilities but financial enablers when used smartly. They help build assets, improve financial stability, and create opportunities for growth. However, borrowing should be a preplanned and rational decision, not an emotional or impulsive one. If you want to use loans as a financial tool rather than a burden, consult financial experts who can help you navigate the best loan options for your specific needs.

Need the right loan for your financial growth? Contact Fair Finance for expert guidance and personalized loan solutions!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198