Why Do Secured Loans Like Home Loans, Mortgage Loans, and Project Loans Require Log Fees?

When applying for secured loans such as home loans, mortgage loans, or project loans, borrowers often come across a charge called the log-in fee or log fees. This fee is paid upfront before the lender processes the loan application. But what exactly is a log-in fee, and why is it required?

1. What is a Log-In Fee?

A log-in fee is a non-refundable charge collected by banks and financial institutions at the time of loan application. It is primarily used to cover administrative expenses involved in the initial processing and evaluation of the loan request.

🔹 Key Features of Log Fees:

✅ Charged before the lender begins processing the loan.

✅ It is non-refundable, even if the loan is rejected.

✅ Varies based on loan amount, lender, and borrower profile.

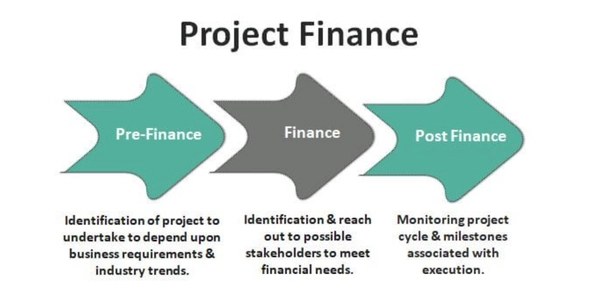

2. Why Do Lenders Charge Log Fees?

Since secured loans involve high-value lending, lenders conduct thorough due diligence before approving the loan. The log-in fee covers the cost of:

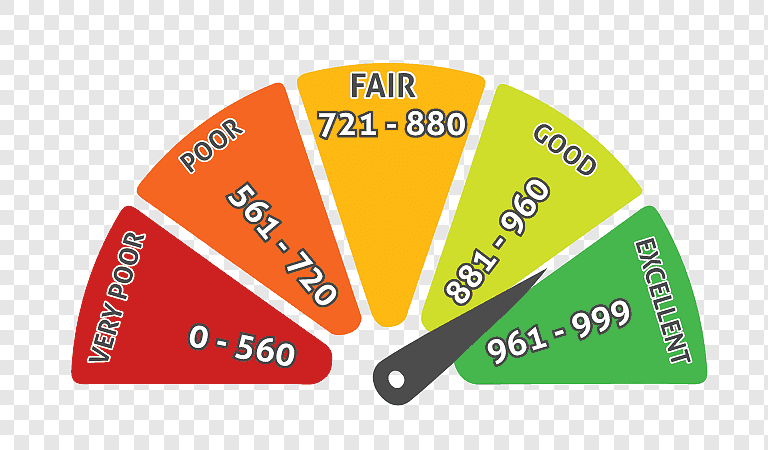

🔹 1. Credit Assessment & Initial Due Diligence

✔ The lender evaluates your CIBIL score, financial history, and repayment capacity.

✔ They check if you meet the eligibility criteria before moving to the next stage.

🔹 2. Legal & Technical Verification of Collateral

✔ For secured loans, lenders assess the property, land, or project offered as collateral.

✔ They verify ownership documents, title deeds, encumbrance certificates, and legal clearances.

✔ A legal expert may be appointed to check for disputes or litigations on the asset.

🔹 3. Site Inspection & Valuation Charges

✔ Physical inspection of the property, land, or project to ensure it meets financing conditions.

✔ Market valuation of the asset to determine the loan-to-value (LTV) ratio.

🔹 4. Administrative & Processing Costs

✔ Covers expenses related to document handling, background verification, and internal approvals.

✔ Banks/NBFCs appoint professionals to scrutinize financial statements, project feasibility reports, and business plans.

3. How Much is the Log-In Fee?

| Loan Type | Log-In Fee Range |

|---|---|

| Home Loan | ₹5,000 – ₹10,000 |

| Loan Against Property | ₹5,000 – ₹25,000 |

| Business Loan (Secured) | ₹10,000 – ₹50,000 |

| Project Loan | ₹25,000 – ₹2,00,000 |

💡 Example: If you apply for a ₹5 crore project loan, the log fee may be around ₹50,000 to ₹2,00,000, depending on the lender and project complexity.

4. Is the Log-In Fee Refundable?

❌ No, the log-in fee is non-refundable, even if:

- The loan application is rejected.

- You decide to withdraw the application.

💡 Tip: To avoid losing money, ensure preliminary eligibility before applying.

5. How to Minimize Log-In Fees?

📌 Negotiate with the Lender:

✔ Some banks offer discounts or waive log fees for existing customers or high-credit borrowers.

📌 Apply for Loans Through DSA (Direct Selling Agents):

✔ Some DSAs or financial consultants help in reducing or negotiating log-in charges.

📌 Compare Lenders Before Applying:

✔ Some banks charge lower log fees, while others adjust them against processing fees if the loan is approved.

📌 Ensure Your Documents Are in Order:

✔ Avoid rejection by having all legal and financial documents ready before applying.

6. Conclusion: Is Paying Log Fees Worth It?

✅ While log-in fees add to the upfront cost of borrowing, they ensure that lenders conduct proper due diligence before approving large secured loans.

✅ Always verify lender policies on log fees and compare multiple loan offers to get the best deal.

🚀 Make informed borrowing decisions and avoid unnecessary costs!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198