What Are Processing Fees, Prepayment Penalties, and Other Hidden Loan Charges?

When taking a loan, most borrowers focus on the interest rate and EMI amount but often overlook the hidden charges that lenders impose. These charges can increase the total cost of borrowing and impact your repayment strategy.

In this article, we will break down:

✔ Processing Fees

✔ Prepayment & Foreclosure Penalties

✔ Other Hidden Loan Charges

✔ How to Minimize These Costs

1. What Are Processing Fees?

A processing fee is a one-time charge that banks or NBFCs (Non-Banking Financial Companies) impose to cover administrative expenses involved in loan processing.

🔹 Key Features of Processing Fees

✅ It is usually non-refundable, even if your loan application is rejected.

✅ Charged as a fixed amount or percentage of the loan amount.

✅ Varies based on loan type, lender, and credit profile.

💰 How Much Are Processing Fees?

| Loan Type | Processing Fee Range |

|---|---|

| Home Loan | 0.25% – 1% of loan amount (₹5,000 – ₹25,000) |

| Personal Loan | 1% – 3% of loan amount |

| Business Loan | 1% – 2.5% of loan amount |

| Car Loan | 0.5% – 1% of loan amount |

| Loan Against Property | 0.5% – 1.5% of loan amount |

Example: If you take a ₹10 lakh personal loan and the processing fee is 2%, you will pay ₹20,000 upfront as a processing charge.

💡 Tip: Some lenders offer zero processing fee loans during festive seasons. Always check for such offers before applying.

2. What Are Prepayment & Foreclosure Penalties?

Prepayment or foreclosure refers to repaying a loan before the scheduled tenure. While it helps save interest, lenders charge penalties to compensate for lost interest income.

🔹 Types of Prepayment Charges

✅ Prepayment Penalty: Charged when you make partial payments toward the principal before the due date.

✅ Foreclosure Charges: Applied when you pay off the entire loan early and close the loan account.

💰 How Much Are Prepayment & Foreclosure Charges?

| Loan Type | Prepayment Charges | Foreclosure Charges |

|---|---|---|

| Home Loan | 0% for floating rate | 2% – 5% for fixed rate |

| Personal Loan | 2% – 5% of the outstanding amount | 3% – 5% |

| Business Loan | 2% – 4% | 3% – 5% |

| Car Loan | 3% – 6% | 3% – 6% |

| Loan Against Property | 2% – 4% | 3% – 5% |

Example: If you have a ₹5 lakh loan with 4% foreclosure charges, you’ll pay ₹20,000 extra to close the loan early.

💡 Tip: Look for loans with no prepayment penalties, especially for floating interest rate loans like home loans.

3. Other Hidden Loan Charges

Apart from processing and prepayment fees, lenders may apply various other charges that can increase your borrowing cost.

🔹 1. Late Payment Fees

✅ If you miss an EMI payment, lenders impose a late fee of ₹500 to ₹1,500 or 2%-3% of the overdue amount.

✅ It affects your credit score, making future loans costlier.

💡 Tip: Always set up auto-debit for EMI payments to avoid penalties.

🔹 2. Loan Insurance Charges

✅ Some lenders bundle insurance with loans and charge premiums without informing borrowers.

✅ It’s an additional cost that is deducted upfront from the loan amount.

💡 Tip: Always ask if loan insurance is mandatory or optional before signing the loan agreement.

🔹 3. Loan Cancellation Charges

✅ If you cancel a loan after approval, you may be charged ₹3,000 to ₹5,000 as a cancellation fee.

✅ Some lenders also forfeit the processing fee.

💡 Tip: Compare loan options before applying to avoid cancellation fees.

🔹 4. Documentation & Legal Charges

✅ Some loans require additional legal verification or document processing (e.g., home loans, business loans).

✅ Charges range from ₹1,000 to ₹10,000, depending on the lender.

💡 Tip: Ask for a detailed fee structure before proceeding with a loan application.

🔹 5. Balance Transfer Charges

✅ If you transfer your loan to another lender for better interest rates, you may incur a 1%-2% charge on the outstanding amount.

💡 Tip: Ensure that the savings from the lower interest rate outweighs the balance transfer fee.

🔹 6. GST on Loan Charges

✅ All loan-related fees attract an 18% GST, increasing the overall cost.

✅ For example, a ₹10,000 processing fee will have an ₹1,800 GST, making the total cost ₹11,800.

💡 Tip: Consider GST charges while calculating total loan costs.

4. How to Minimize Loan Charges?

📌 Compare Multiple Lenders:

✔ Use loan comparison tools to find low-processing fee and zero prepayment charge loans.

📌 Read the Fine Print:

✔ Check all charges in the loan agreement before signing.

📌 Negotiate with the Lender:

✔ Some lenders waive processing fees for premium customers or during festive offers.

📌 Make EMI Payments on Time:

✔ Avoid late fees and penalties by ensuring timely EMI payments.

📌 Check for No Prepayment Penalty Loans:

✔ Prefer floating rate loans, as they typically have zero prepayment penalties.

📌 Opt for Digital Loans with Minimal Charges:

✔ Many fintech lenders offer zero processing fees and lower hidden costs compared to traditional banks.

5. Final Thoughts: Smart Borrowing Saves Money

Hidden loan charges can increase your borrowing cost significantly if you don’t pay attention. Always ensure you:

✅ Compare processing fees, prepayment penalties, and other charges before choosing a loan.

✅ Read the loan agreement carefully to avoid surprises.

✅ Make timely payments to avoid unnecessary penalties.

🚀 Borrow smart, save money, and stay financially stress-free!

Take the Next Step!

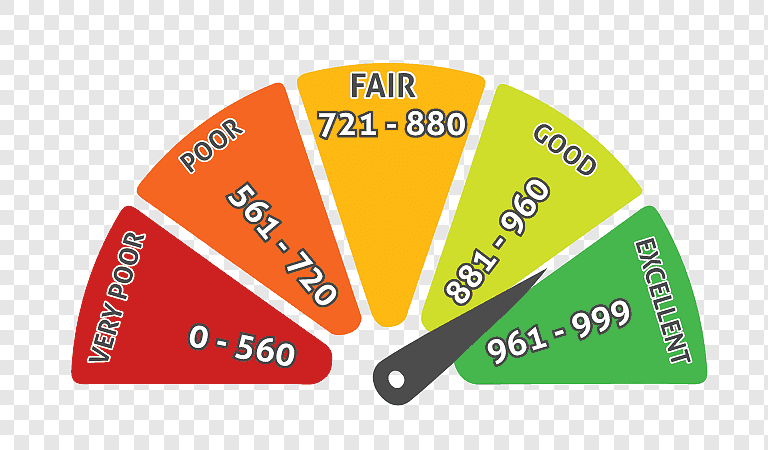

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

📞 Contact Us Today for a free loan consultation and explore the best deals tailored to your financial needs!

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198