Should You Take a Consumer Loan in India? Risks & Rewards Explained

With the increasing cost of living, consumer loans have become a popular way for Indians to afford big-ticket items like smartphones, electronics, furniture, and even travel. Options like No-Cost EMI, Buy Now Pay Later (BNPL), and Personal Loans make purchases more accessible, but are they truly beneficial?

Before opting for a consumer loan, let’s understand its benefits, risks, and key considerations from an Indian financial perspective.

1. What is a Consumer Loan?

A consumer loan is a type of credit that helps individuals finance personal expenses. It includes:

🔹 Buy Now Pay Later (BNPL)

✔ Offered by fintech firms like ZestMoney, Simpl, LazyPay, Amazon Pay Later, Flipkart Pay Later

✔ Allows instant purchases with zero or low interest EMIs

✔ Payment is spread over 3, 6, or 12 months

✔ Requires minimal documentation

Example: You buy a ₹50,000 smartphone on Flipkart Pay Later and pay ₹8,333/month for 6 months with no interest.

🔹 No-Cost EMI & Credit Card EMI

✔ Available from banks like HDFC, ICICI, SBI, Axis, Kotak, and Bajaj Finserv

✔ Used for purchases of gadgets, appliances, and luxury goods

✔ The interest is pre-adjusted in the price, so it seems like zero cost

✔ Usually requires a credit card or Bajaj Finserv EMI Card

Example: A ₹60,000 laptop bought with HDFC No-Cost EMI at ₹10,000/month for 6 months.

🔹 Personal Loans for Consumer Goods

✔ Available from banks, NBFCs, and fintech lenders

✔ Interest rates range from 10% to 24% p.a.

✔ Loan tenure is typically 6 months to 5 years

✔ Requires income proof & CIBIL score above 700

Example: Taking a ₹1 lakh personal loan at 12% interest for a foreign trip and repaying over 12 months at ₹9,000/month.

2. Benefits of Consumer Loans

✅ 1. Immediate Access to Expensive Products

✔ Buy high-value items without paying upfront.

✔ Helps salaried individuals manage cash flow better.

✅ 2. No-Cost EMI Makes Expensive Purchases Affordable

✔ Available on gadgets, home appliances, furniture, and even travel.

✔ Many e-commerce platforms offer Zero-Cost EMI deals.

✅ 3. Easy Approval & Minimal Documentation

✔ BNPL and EMI loans are approved instantly with minimal KYC.

✔ No heavy paperwork like traditional loans.

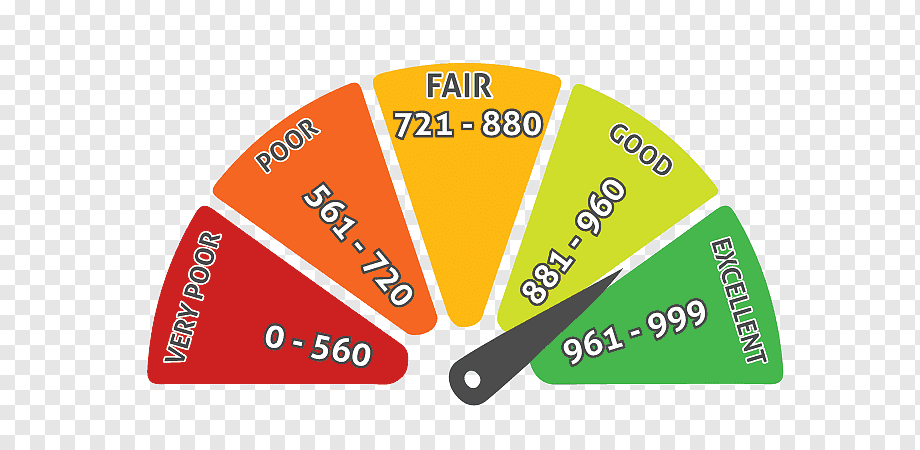

✅ 4. Can Help Build Credit Score

✔ Timely payments improve CIBIL score.

✔ Better credit score helps in getting higher loan amounts in the future.

3. Risks & Disadvantages of Consumer Loans

❌ 1. Hidden Fees & High Interest on Defaults

🔹 BNPL and EMI schemes appear interest-free, but late payments attract heavy charges.

🔹 Many lenders charge processing fees (2-4%).

Example: A missed Amazon Pay Later EMI of ₹5,000 can attract ₹500-₹1,000 late fees.

❌ 2. Encourages Overspending & Debt Trap

🔹 Easy financing makes luxury purchases tempting, leading to unnecessary loans.

🔹 BNPL and EMIs can accumulate multiple liabilities if mismanaged.

Example: Taking EMI plans for a ₹1.5 lakh iPhone, a ₹70,000 laptop, and a ₹50,000 TV could lead to ₹20,000+ monthly EMIs, impacting savings.

❌ 3. Negative Impact on CIBIL Score If You Miss Payments

🔹 Late or missed EMIs are reported to credit bureaus, reducing your CIBIL score.

🔹 BNPL loans increase credit utilization, affecting future loan approvals.

Example: A missed ₹5,000 EMI can lower CIBIL score by 30-50 points.

❌ 4. Loan Lock-In & No Flexibility

🔹 BNPL and EMI loans lock you into fixed payments for 3-24 months.

🔹 Pre-closing a personal loan may attract prepayment penalties.

4. Consumer Loan Comparison: BNPL vs. EMI vs. Personal Loan

| Feature | BNPL (Buy Now Pay Later) | No-Cost EMI | Personal Loan |

|---|---|---|---|

| Approval Time | Instant | Instant | 24-48 hours |

| Interest Rate | 0% initially, high later | 0% (subsidized) | 10%-24% p.a. |

| Processing Fees | Possible | 2-4% | 1-3% |

| Late Payment Fees | High | High | Yes |

| CIBIL Impact | Affects score if missed | Affects score if missed | Affects score |

| Best For | Small purchases (₹2,000-₹50,000) | Gadgets, appliances | Big-ticket expenses |

5. Should You Take a Consumer Loan?

💡 YES, If:

✔ You need to spread payments without high interest.

✔ You qualify for 0% EMI offers and can pay on time.

✔ You are financially disciplined and won’t overspend.

🚨 NO, If:

❌ You already have other loans or credit card bills.

❌ You struggle with monthly budgeting.

❌ You are using loans for unnecessary luxury purchases.

6. Smarter Alternatives to Consumer Loans

✔ Debit Card EMI Plans – Some banks offer direct EMI options on debit cards (like HDFC & SBI).

✔ Planned Savings – Save monthly and buy later without loans.

✔ Corporate & Student Discounts – Check for discounts instead of taking an EMI.

✔ Credit Card Offers – Some credit cards offer cashbacks & discounts instead of loans.

Final Verdict: Should You Take a Consumer Loan?

✔ Good Choice if used responsibly for essential purchases.

❌ Risky if it leads to excessive debt and financial burden.

⚠️ Golden Rule: Take a loan only if you can repay on time. If in doubt, it’s best to save and buy later.

📞 Need help managing loans and finances? Contact Fair Finance today!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198