What Happens If You Miss an EMI Payment? Consequences & Solutions

Missing an Equated Monthly Installment (EMI) payment can have serious financial consequences, impacting your credit score, increasing your debt burden, and even leading to legal action in extreme cases. However, if you have missed or are at risk of missing an EMI, there are solutions to mitigate the damage.

This guide explains the consequences of missing an EMI and the best ways to manage the situation.

1. Immediate Consequences of Missing an EMI

🔴 Late Payment Fees & Penalties

Lenders charge a late payment fee if you fail to pay your EMI on time. This can be a fixed amount or a percentage of your EMI.

Example: If your EMI is ₹10,000 and the penalty is 2% per month, you will have to pay ₹200 extra for every month of delay.

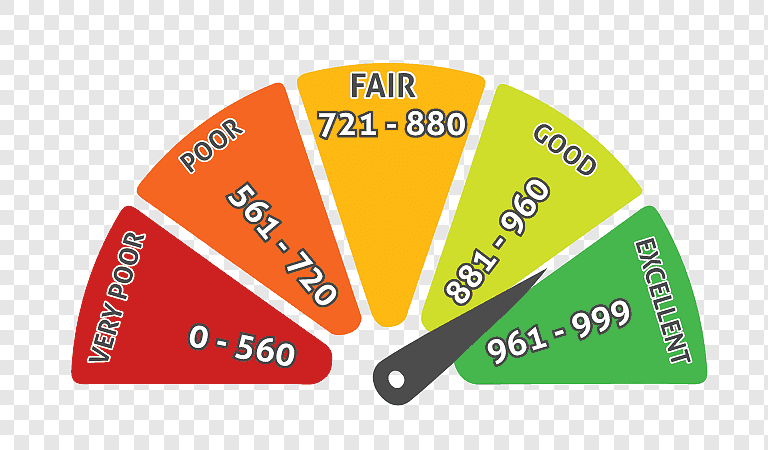

🔴 Negative Impact on Credit Score

Your credit score (CIBIL score) drops if you miss a payment. A lower score can make it difficult to:

✔ Get future loans

✔ Negotiate lower interest rates

✔ Get credit card approvals

Fact: A single missed EMI can reduce your credit score by 50-100 points.

🔴 Increased Interest & Accumulated Debt

If you skip multiple EMIs, the unpaid amount is added to your outstanding loan. This means:

✔ Higher interest accumulation

✔ Increased overall debt burden

✔ Higher next EMI payments

2. Long-Term Consequences of Repeated EMI Defaults

🔻 Risk of Loan Restructuring or Repossession

If you default continuously for 3-6 months, the lender may classify your loan as a Non-Performing Asset (NPA).

✔ For Secured Loans (Home, Car, Mortgage, etc.): The lender can seize and auction the collateral (property, vehicle, etc.).

✔ For Unsecured Loans (Personal, Credit Card, etc.): Your interest rate may increase, and legal action can be taken.

🔻 Legal Action & Collection Agents

✔ After 90-180 days of non-payment, lenders may send legal notices.

✔ For credit card and personal loans, recovery agents may be assigned.

✔ Court proceedings can be initiated for high-value defaults.

Note: RBI guidelines state that recovery agents must follow ethical practices—harassment is illegal.

3. Solutions: What to Do If You Miss an EMI Payment?

🟢 1. Pay Immediately & Avoid Further Delays

✔ If you’ve missed an EMI, pay as soon as possible to avoid penalties and credit score damage.

🟢 2. Contact Your Lender & Request a Grace Period

✔ Many banks/NBFCs offer a grace period (3-15 days) for EMI payments.

✔ Inform your lender about your financial difficulties—they may allow a delayed payment without penalties.

🟢 3. Opt for Loan Restructuring

✔ If you are facing a long-term financial crisis, request a revised repayment plan.

✔ Lenders may reduce EMI, extend tenure, or offer a moratorium (temporary payment break).

🟢 4. Consider Loan Refinancing

✔ If your current loan has high EMIs, refinance with a lower interest rate from another bank/NBFC.

✔ Balance transfer can reduce your financial burden.

🟢 5. Use Savings or Emergency Funds

✔ If you have an emergency fund, use it to cover EMIs and prevent default.

✔ Avoid taking another loan to pay missed EMIs—it may lead to a debt trap.

🟢 6. Set Up Auto-Debit or EMI Alerts

✔ Automate your EMI payments through your bank.

✔ Set up SMS/email reminders to avoid missing deadlines.

4. How to Avoid EMI Defaults in the Future?

✅ Borrow Wisely: Ensure EMIs do not exceed 40% of your monthly income.

✅ Keep an Emergency Fund: Maintain 3-6 months’ worth of EMI savings.

✅ Increase EMI Tenure if Needed: Lower EMIs ensure smoother repayment.

✅ Check Your Loan Terms Carefully: Be aware of late fees, penalties, and restructuring options.

Final Thoughts

Missing an EMI can negatively impact your finances and creditworthiness. However, acting quickly, communicating with your lender, and planning ahead can help you manage the situation effectively.

📞 Need expert guidance on managing EMI payments? Contact Fair Finance for personalized loan advisory!

Take the Next Step!

Looking for the right loan but unsure which one suits you best? Fair Finance offers expert consultation to guide you through your loan options and ensure you make an informed decision.

👉 Visit our 🌐 website: www.fairfinance.in

📧 Email us: fairfinance.in@gmail.com

📞 Call us: +91 9123309198