What Happens If You Take a Loan from an Unauthorized Lender?

Many borrowers turn to unauthorized lenders for quick financial relief, often unaware of the severe consequences. These lenders operate outside financial regulations, making them extremely risky. If you’ve taken a loan from an unregulated lender, here’s what you need to know.

1. Unreasonably High Interest Rates

Unauthorized lenders often charge excessively high interest rates, sometimes exceeding 50-100% annually. Borrowers end up paying far more than expected, leading to a never-ending cycle of debt.

2. No Legal Protection

Since these lenders are not recognized by regulatory bodies like the Reserve Bank of India (RBI), borrowers have no legal recourse in case of disputes, unfair practices, or fraud.

3. Aggressive & Harassing Collection Tactics

Many unauthorized lenders use unethical and illegal recovery methods, including threats, harassment, public shaming, and unauthorized access to personal contacts.

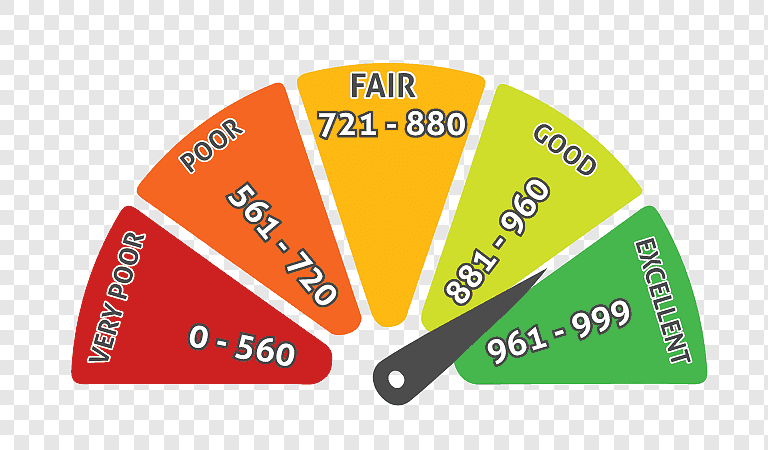

4. No Credit Score Benefits

Loans from unauthorized lenders do not contribute to improving your credit history. However, if you default, they may still report you to unofficial credit agencies, damaging your financial credibility.

5. No NOC (No Objection Certificate) After Repayment

Many borrowers face difficulties obtaining a NOC even after full repayment. This leads to ongoing financial stress, as records of the loan remain unclear, making future borrowing difficult.

6. Risk of Identity Theft & Financial Fraud

Unregulated lenders often misuse borrowers’ personal information, leading to identity theft, unauthorized transactions, and financial fraud.

How Fair Finance Can Help You

If you have taken a loan from an unauthorized lender and are facing repayment issues, harassment, or financial instability, Fair Finance is here to help!

✅ Debt Resolution Services – We assist borrowers in settling unauthorized loans and negotiating repayment terms. ✅ Legal & Financial Guidance – Our experts help in handling disputes, ensuring fair resolutions, and protecting your financial rights. ✅ Credit Score Restoration – If your credit score has been affected by such loans, we offer personalized solutions to repair and restore it. ✅ Regulated Loan Alternatives – We connect borrowers with trusted and legally compliant lenders for safer and more affordable financial solutions.

Don’t Let Unauthorized Lenders Control Your Financial Future!

If you’ve taken a loan from an unregulated lender and need help, Fair Finance can guide you to financial recovery.

📞 Call us at +91 9123309198

🌐 Visit our website: www.fairfinance.in

💰 Apply for a paid consultation now and take the first step toward securing your financial stability!